Does your company store, process, or transmit cardholder data? If so, then there is a good chance that you are aware of the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS requirements are constantly changing and companies must continually evaluate their threat landscape in order to ensure their security program is up-to-date. To meet this standard you must ensure that the requirements are not just met but are built into your current security process.

A key component to PCI compliance is having a pentest performed on services within your cardholder data environment (CDE). (This can go hand in hand with a PCI vulnerability scan as well.)

PCI compliance is more than just application layer, it is also the surrounding and connected networks including anything that touches the CDE.

What is a PCI Pentest?

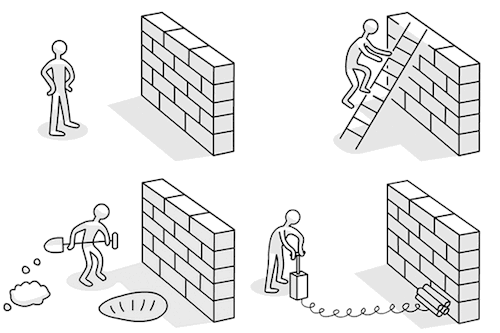

A PCI DSS pentest is a cybersecurity assessment examining the technical and operational components of a system that collects payment and cardholder data to ensure that they meet the PCI compliance standards. PCI Testing assesses a network's infrastructure and applications, both internally and externally to identify potential vulnerabilities proactively.

This standard was developed and is maintained by the Payment Card Industry (PCI) Security Standards Council, and has helped raise the bar for information security compliance with regard to protecting cardholder data. PCI pentests are a highly effective way of reviewing an application as they replicate the steps a malicious attacker would take to infiltrate a system.

PCI pen testing also prevents businesses from having to pay for the hefty expenses associated with recovering from a security breach. By proactively identifying any gaps, companies are able to act before irreversible damage takes place. A PCI test is also a way to show your customers that you care about their data and are taking steps to ensure that it is properly protected.

Which Organizations are Vulnerable to PCI Threats, and How Can PCI Testing Help?

PCI DSS defines cardholder data environment (CDE) as “the people, processes, and technology that store, process, or transmit cardholder data or sensitive authentication data”. These PCI tests should be performed on any application or infrastructure that stores, processes, or transmits credit or debit card data, providing a comprehensive review of potential vulnerabilities.

PCI applies to all entities involved in payment card processing — including merchants, processors, acquirers, issuers, and service providers. As mentioned above, PCI applies to all other entities that store, process, or transmit cardholder data and/or sensitive authentication data.

What are the PCI DSS Requirements?

The PCI DSS framework is an extensive set of guidelines that help business owners maintain safe cardholder data practices at every step of the payment process.

PCI DSS requirements include:

* The use of strong passwords, and the regular updating of all passwords used within your organization

* Ensuring adequate cryptographic initialization and service on all ATM machines

* Scanning of e-commerce environments by using an Authorized Scan Vendor (ASV)

* Effective daily log monitoring

* The creation of instructional materials for the implementation and use of mobile payment systems

Of course, these are just a few of the compliance standards set forth by the PCI Security Standards Council.

Conducting a PCI compliance check and maintaining PCI compliance is beneficial for companies of all types, as it demonstrates the organization’s dedication to upholding the recommended standards of protection.

By showing that your company engages in regular PCI compliance testing. you are establishing trust with the customers you serve, procuring better client relationships and enhancing your bottom line results.

How Cobalt Can Help with PCI Compliance Testing

We provide pentests that follow the requirements set forth by the PCI Security Standards Council. These requirements include: pentesting components, qualified pentesters, methodologies, and reporting guidelines.

We draw on a core of highly vetted pentesters to find the right skills to match your security requirements and business needs.

We conduct each PCI pentest as if we were performing it for our own business, placing the utmost importance on accuracy, meticulousness, and compliance.

But that’s not all. At Cobalt, we don’t just *identify *vulnerabilities, we provide you with clear, actionable plans to fix them.

Upon completing your PCI pentest, our skilled pentesters will assign reports to your team members via your preferred workflows, such as Jira or Github. This makes resolving issues a streamlined process for all involved.

At this phase, you can collaborate directly with the pentesters via the Cobalt platform on fixing any discovered issues. Using a built-in workflow the pentesters will also do re-testing to verify your patches at no extra charge.

In a nutshell? We will assist you with your PCI DSS 11.3 pentest requirements from start to finish.

If you have been looking into PCI DSS 11.3 pentesting compliance, we encourage you to schedule a demo today.

Still have questions or concerns about PCI pentesting, PCI compliance testing, or PCI penetration testing vendors that weren’t answered here? We are always available to chat. Contact us today!

Please note:

Cobalt does not currently provide PCI vulnerability scans to meet the PCI Authorized Scan Vendor (ASV) requirements. Scans differ from PCI pentests, as they are executed using automated scanning tools, whereas Cobalt’s PCI pentest offering is manual pentest performed by skilled security professionals.

To learn more about the differences between PCI compliance scans and PCI pentests, you can reach out to one of our knowledgeable Cobalt representatives today. We’d be happy to recommend which solution is the best fit for your company’s needs.