-

Platform

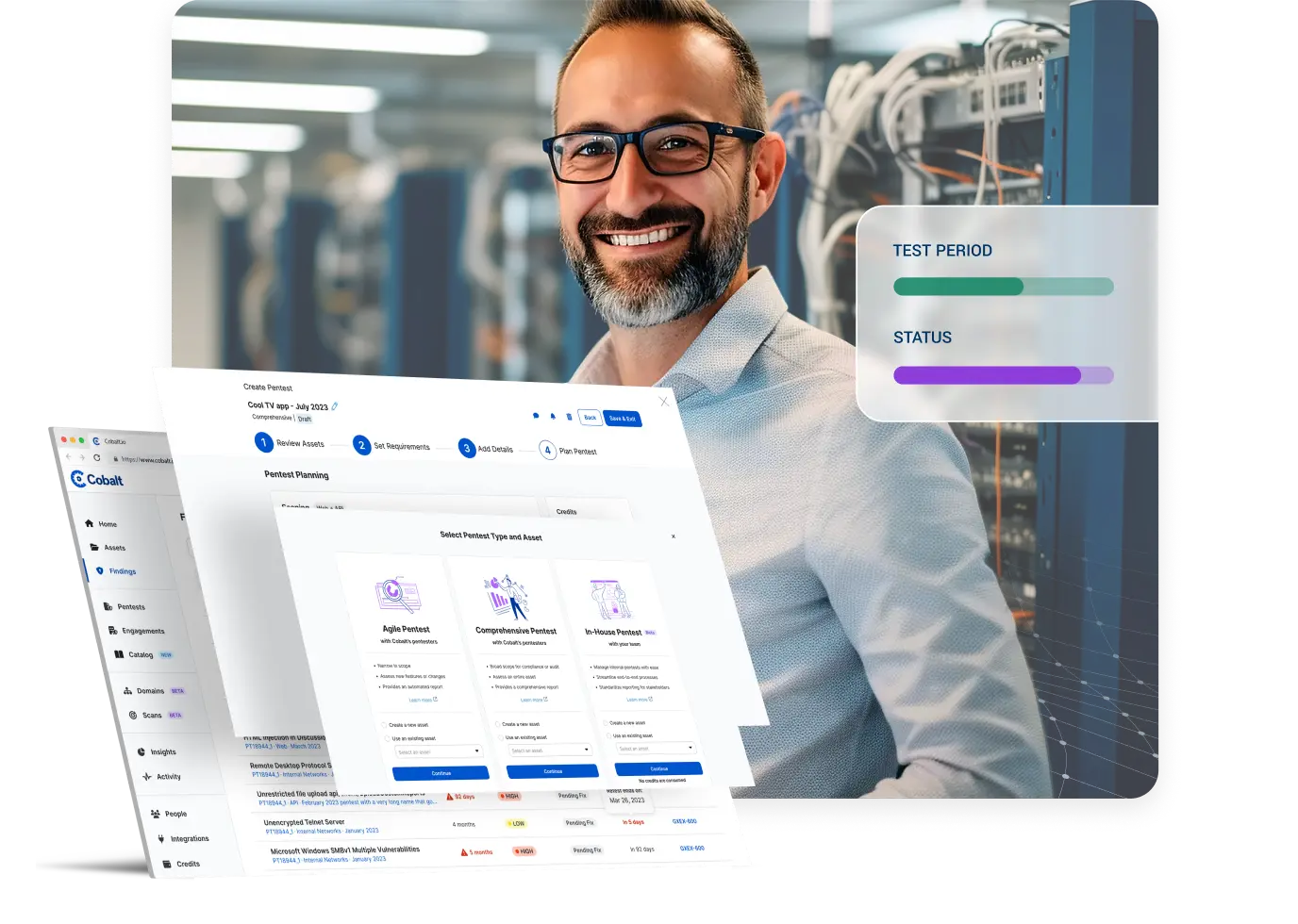

Cobalt Platform

Modern offensive security platform and pioneers in penetration testing as a service (PTaaS)Offensive Security Program

Go beyond one-off pentests with a continuous program of testing, fix validation, and strategic guidance.PTaaS

On-demand penetration testing as a service platform. Start a pentest in as little as 24 hoursIntegrations

Automate workflows to identify and remediate vulnerabilities fasterCobalt Core

Meet the community of skilled and highly-vetted penetration testing expertsWhy Cobalt

Explore why customers love working with Cobalt for their offensive security service needsPricing

Explore the flexible Cobalt credit model for all your penetration testing needs

State of Pentesting Report

Learn what 10 years of pentesting data tells us about addressing risks -

Services

Pentest Services

Proactively identify and mitigate risks with penetration testing servicesApplication Security

Modern penetration testing services for fast-moving product development teamsNetwork & Cloud Security

Penetration testing across your perimeter and into the cloudInfoSec & SOC Services

Test your system defenses against real-world attacks -

Solutions

By Use Case

Go beyond one-off pentests with a continuous program of testing, fix validation, and strategic guidance -

Resources

Resource Library

Essential reading and toolkits for modern cybersecurity professionalsDemo Center

Explore the features, insights, and automation that help teams deliver high-impact pentests.Blogs

Sharpen your skills with expert commentary and practical security adviceLearning Center

Learn the fundamentals of offensive security and strengthen your cyber defensesEvents and Webinars

Live and on-demand training for today's most pressing security challengesCase Studies

Explore real customer stories and see their delight straight from the source

The Responsible AI Imperative

Discover the security challenges of AI adoption and how to address them. -

About

Leadership

Meet the executive leadership team driving our missionPartners

Explore the Cobalt partnership network and apply to become a partner todayNewsroom

Read the latest news stories and press coverageTrust Center

Transparency is important. See our approach to data privacy, security, and complianceAbout Us

Learn how Cobalt infuses manual security testing with speed, simplicity, and transparencyCareers

Join Cobalt to help us redefine and reimagine offensive securityContact Us

Get in touch with a member of our team

Pentesting Pulse Report

How speed, AI, and quality are driving change in modern security testing - Get A Demo

- Login

WHITE PAPER

Secure the agentic shift and bridge the AI readiness gap with the Responsible AI Imperative white paper

-

Platform

Cobalt Platform

Modern offensive security platform and pioneers in penetration testing as a service (PTaaS)Offensive Security Program

Go beyond one-off pentests with a continuous program of testing, fix validation, and strategic guidance.PTaaS

On-demand penetration testing as a service platform. Start a pentest in as little as 24 hoursIntegrations

Automate workflows to identify and remediate vulnerabilities fasterCobalt Core

Meet the community of skilled and highly-vetted penetration testing expertsWhy Cobalt

Explore why customers love working with Cobalt for their offensive security service needsPricing

Explore the flexible Cobalt credit model for all your penetration testing needs

State of Pentesting Report

Learn what 10 years of pentesting data tells us about addressing risks -

Services

Pentest Services

Proactively identify and mitigate risks with penetration testing servicesApplication Security

Modern penetration testing services for fast-moving product development teamsNetwork & Cloud Security

Penetration testing across your perimeter and into the cloudInfoSec & SOC Services

Test your system defenses against real-world attacks -

Solutions

By Use Case

Go beyond one-off pentests with a continuous program of testing, fix validation, and strategic guidance -

Resources

Resource Library

Essential reading and toolkits for modern cybersecurity professionalsDemo Center

Explore the features, insights, and automation that help teams deliver high-impact pentests.Blogs

Sharpen your skills with expert commentary and practical security adviceLearning Center

Learn the fundamentals of offensive security and strengthen your cyber defensesEvents and Webinars

Live and on-demand training for today's most pressing security challengesCase Studies

Explore real customer stories and see their delight straight from the source

The Responsible AI Imperative

Discover the security challenges of AI adoption and how to address them. -

About

Leadership

Meet the executive leadership team driving our missionPartners

Explore the Cobalt partnership network and apply to become a partner todayNewsroom

Read the latest news stories and press coverageTrust Center

Transparency is important. See our approach to data privacy, security, and complianceAbout Us

Learn how Cobalt infuses manual security testing with speed, simplicity, and transparencyCareers

Join Cobalt to help us redefine and reimagine offensive securityContact Us

Get in touch with a member of our team

Pentesting Pulse Report

How speed, AI, and quality are driving change in modern security testing - Get A Demo

- Login

WHITE PAPER